No More Luxury Cars for Non-Filers Over Rs. 7 Million

No More Luxury Cars for Non-Filers Over Rs. 7 Million

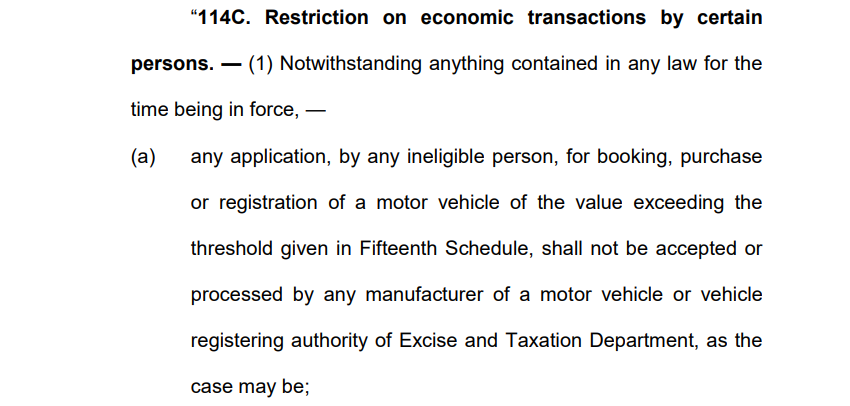

The Finance Act 2025 has introduced a major change in Pakistan’s tax and vehicle policy: a strict non-filers car ban on vehicles priced above Rs. 7 million. As per the updated car buying law, individuals who have not filed their income tax returns will no longer be allowed to book, purchase, or register high-value motor vehicles. This is a clear attempt to bring more people into the tax net and discourage unreported economic activity.

What the Law States

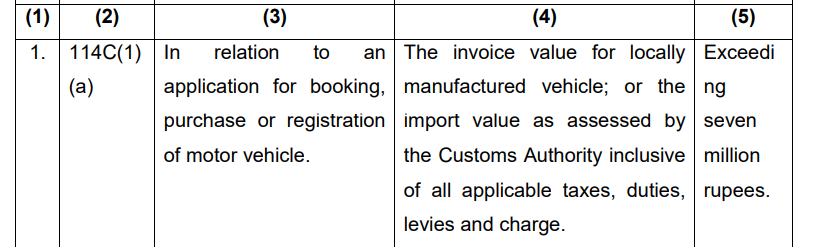

This non-filers car policy is now officially part of the Fifteenth Schedule of the Income Tax Ordinance under Section 114C. The legal clause states that any locally manufactured vehicle (based on invoice value) or imported vehicle (based on assessed customs value) exceeding Rs. 7 million cannot be bought, registered, or booked by a non-filer. This car purchase limit is firm, with no grace period or exception.

The expensive car ban doesn’t only target direct purchases—it also applies to transactions made through family members, associates, or proxies. Attempting to use someone else's name or undeclared income won't work under this tightly enforced rule.

Who Falls Under the Restriction?

The policy defines ineligible buyers as anyone who hasn’t filed an income tax return for the prior year or lacks sufficient assets or income in declared statements. Even if a person has enough funds, they must demonstrate that capacity through proper documentation. The non-filers vehicle limit is aimed at blocking all loopholes that might be used to bypass the tax system.

How the Ban Will Be Enforced

Authorities have designed the enforcement process to be watertight. If a non-filer attempts to purchase a vehicle over Rs. 7 million:

- Dealerships won’t allow bookings,

- Excise departments will reject registrations,

- Banks may decline financing or payments linked to such transactions.

This nationwide luxury car restriction ensures that all high-end vehicle ownership stays within the bounds of tax filer car policy requirements.

A Big Step in Car Ban Pakistan Drive

With this move, the government is clearly prioritizing transparency and tax compliance. The non-filers tax rule serves as a deterrent against lavish spending by those outside the tax net. This step reflects the broader strategy under the Car Ban Pakistan initiative to link high-value purchases directly with documented income.

The Finance Act 2025 now ties luxury vehicle ownership to tax return filing—marking a turning point in Pakistan’s fiscal enforcement landscape.

Nonfilers car ban

Luxury car restriction

Car purchase limit

Expensive car ban

Nonfilers tax rule

Car buying law

Nonfilers vehicle limit

Tax filer car policy

Car ban Pakistan

Nonfilers car policy

Related Auto News Updates

Latest Discussions

Comments

Add a Comment "No More Luxury Cars for Non-Filers Over Rs. 7 Million"